Unlocking Value: A Buy Recommendation for Joby Aviation Post Secondary Offering Disclosure

- Leo Choi

- Oct 31, 2024

- 4 min read

Summary:

Joby Aviation announced a $200 million public offering, with an additional $30 million option for underwriters, resulting in a potential issuance of 46.24 million shares and an estimated 6.12% dilution of existing shares.

The analysis uses two approaches: calculating share dilution impact using the treasury stock method and assessing potential returns on equity proceeds based on historical ROE trends and the estimated cost of equity.

We are initiating coverage on JOBY with a "Buy" recommendation and a target price of $5.44, representing a 9.6% potential upside based on the current analysis price.

Catalyst:

On October 24, 2024, after trading hours, Joby Aviation, Inc. (NYSE: JOBY), a company developing electric air taxis for commercial passenger service, announced an underwritten public offering to sell up to $200 million of its common stock [1]. Additionally, JOBY plans to grant underwriters a 30-day option to purchase up to an additional $30 million of its common stock [1]. The company intends to use the net proceeds from the offering, along with its existing cash, cash equivalents, and short-term investments, to support its certification and manufacturing efforts, prepare for commercial operations, and cover general working capital and other corporate purposes [1].

Analytical Framework Outline

We assess the impact of the proposed offering in two ways. First, we evaluate the percentage dilution by estimating the approximate number of shares to be issued, taking into account both the core offering and the options granted to underwriters. For this analysis, we apply the treasury stock method, assuming the offer price is equal to JOBY's current market price.

Second, we assess the potential return on equity proceeds from the proposed share offering. We take a historical perspective to estimate potential gains from the equity proceeds, with gains and losses spread across multiple years. This impact is analyzed on a present value basis using our estimate of JOBY's cost of equity.

Finally, we consolidate all impacts with reference to the benchmark price and date, which we set at the latest closing price before the announcement: $6.04 per share, the closing price on October 24, 2024.

% Dilution

Based on the latest quarterly filing, JOBY had 753,879,600 common shares outstanding. Given the current market price of $4.99 per share at the time of our analysis, this implies approximately 40.12 million shares will be issued under the core offering to raise $200 million. Including the additional 6.02 million shares from the underwriters' option, we estimate that raising a total of $230 million will require issuing 46.24 million shares. This results in an approximate 6.12% dilution for existing shareholders.

Return on Proceeds

Focusing solely on the equity dilution from the secondary offering is indeed an aggressive approach, as this analysis neglects the potential use of net proceeds and the potential benefits to shareholders. In JOBY's case, this approach appears to be particularly conservative, especially when considering the historical return on equity proceeds, alongside the firm’s operational performance and historical profitability.

As illustrated above, the company has yet to achieve a profitable year in terms of return on equity (ROE %), with a median ROE of -33.70%. If ROE remains in negative territory at this level, it suggests an approximate annual loss of $78 million on the $230 million raised through the offering. Assuming this loss continues over multiple years, the implied cumulative loss on the total proceeds could reach $230 million, resulting in the following projected loss schedule.

The loss schedule suggests that, at a median ROE of -33.70%, the equity proceeds will generate losses over the next three years. However, rather than using the nominal loss directly to assess per-share impact, we must consider its present value. To accomplish this, we estimate the cost of equity using the Capital Asset Pricing Model (CAPM), incorporating the 10-year U.S. Treasury yield as the risk-free rate, a 5-year monthly regression beta of 1.97, and an equity risk premium of 3.96% [3]. The present values of the nominal losses are discounted and summed, then allocated on a per-share basis by using the adjusted share count (original share count plus the shares issued in the offering), resulting in a per-share loss of $0.23.

Putting it All Together

Using the reference price of $6.04 as of the reference date, we first adjust the per-share price for the dilution percentage arising from both the core and underwriter transactions. We then subtract the $0.23 per-share loss from this dilution-adjusted price, arriving at an implied price estimate of $5.44 per JOBY common share.

Other Considerations

In our independent research, we made two key assumptions concerning our analysis of equity dilution and the expected return on equity proceeds. First, a significant assumption in our base case estimate was that the underwriters' options would be fully exercised. This assumption increases the estimated dilution percentage of existing shares and amplifies the implied per-share loss resulting from the equity proceeds. Additionally, our analysis of return on equity relied on historical ROE % records, focusing on the median ROE % over the company’s operating history to derive the implied price estimate in our base case.

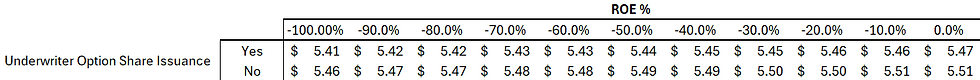

To address these assumptions, we provide the following data table, which presents per-share price estimates across various ROE % scenarios and incorporates the binary optionality associated with the underwriter options.

Sources:

[1] Press Release: Joby Aviation, Inc. Launches Public Offering of Common Stock :: Joby Aviation, Inc. (JOBY)

[2] Latest Quarterly Filing: EDGAR Filing Documents for 0001819848-24-000372

[3] Equity Risk Premium Estimate : Damodaran Online: Home Page for Aswath Damodaran

Comments